Carbon on Chain

Tokenising with a difference

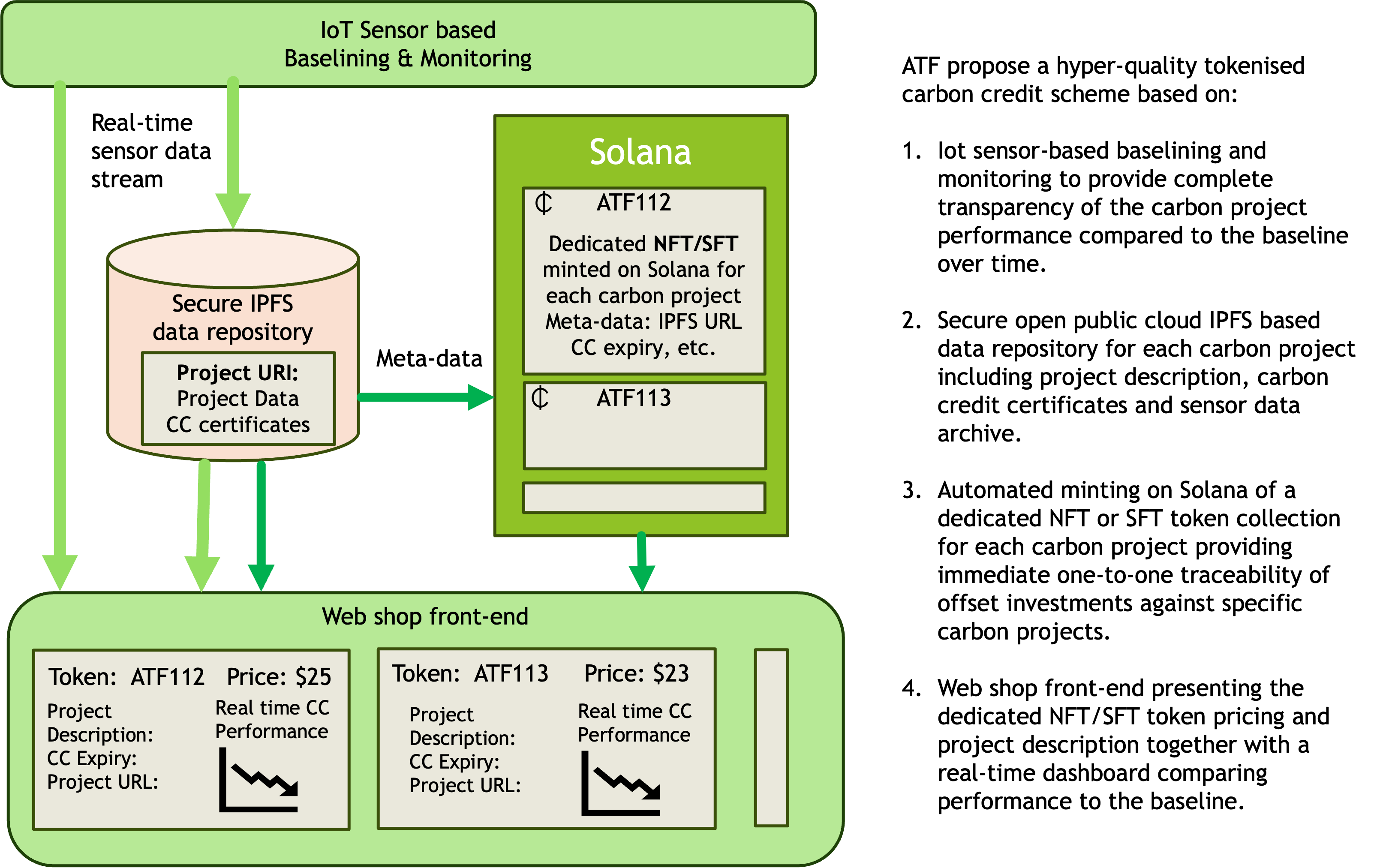

For larger scale carbon projects AFT propose to mint on Solana a limited edition of semi-fungible tokens (SFTs) corresponding to the number carbon credits in the project. The SFTs will include all relevant project data and certifications each wrapping a corresponding fractional ownership of the carbon credits of the project. The token will be tradable via Solana exchanges. The web-shop front-end will present the token name, key project data, latest price and ongoing project performance to baseline.

Minting NFTs or limited editions of SFTs to Solana in one-to-one correspondence with specific carbon projects not only provides immediate transparency and traceability of credit quality but due to the limited number of tokens minted for each project limits the attractiveness of the tokens for purely speculative investment. The market value of the NFTs or SFTs should hence remain firmly linked to the real-world value of the investor contribution to demonstratable the climate impact.

The ATF objective is to enable transparent funding of climate impacting projects rather than creation of a speculative crypo-bubbleUsing digital tech to increase carbon credit quality

Using digital tech to increase carbon credit quality

- Digital baselining and monitoring using IoT sensor data

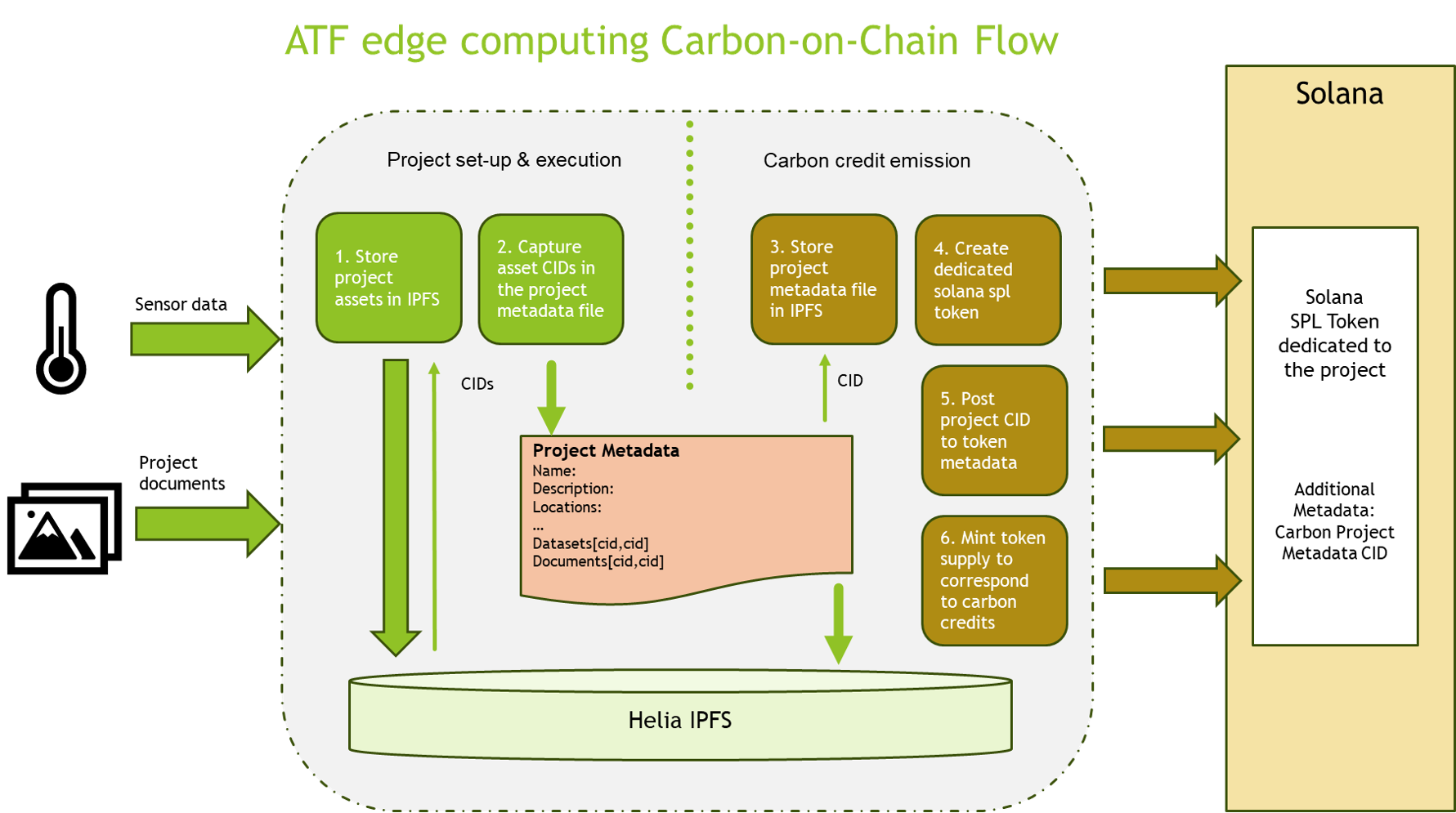

- Secure tamper-proof data archiving using a public IPFS cloud service to hold all project information, certificates and sensor data

- Automated digital set-up of the pipeline from sensor to on-chain carbon credits

- One-to-one traceability between tokens and projects through automated minting of a single dedicated NFT or dedicated limited edition SFTs on Solana. Solana transaction costs enable us to mint specific NFT/SFTs per project.

- IPFS URL and key project data e.g. credits expiry date held in token meta-data

- Web-shop front-end presenting each carbon project with key data, pricing and including a digital dashboard showing the carbon project performance in real-time

- Full transparency of carbon credit expiry at token point of sale

- On-chain trading credits as NFTs or limited edition SFTs on Solana

Premise

The Voluntary Carbon Market (VCM) is in a bit of a credibility crisis due to adverse publicity and the lack of credibility of low-quality carbon credits to generate real environmental impact. Less than 10% of credit issues currently pass rigorous quality and ratings tests.

“The decline in demand for credits with known risk, coupled with the growth in purchases from quality-oriented buyers, may signal the beginning of a transition towards a market that enables buyers to confidently use credit purchases against their climate targets” Source Carbon Direct

Digital MRV can play key role in the high-quality credit marketplace. A pre-qualified IoT solution for MRV including secure IPFS/blockchain based data logging could reduce project overheads and facilitate wider production of high-quality credits.

Sensor-based digital MRV and carbon credit tokenisation combine well together into an end-to-end digital carbon credit pipeline if, and only if, the current challenges to traceability and credibility can be overcome.

The object of ATF is to use digital technology to increase VCM carbon credit quality and transparency

Carbon Credit Tokenisation – State of the Art

Current market initiatives to tokenise VCM carbon credits are based on buying up credits to build a carbon credit pool which then underwrites a cryto token on Etherium. This has significant limitations:

Lack of traceability: There is no one-to-one traceability between a purchased token and a specific carbon project. Purchasers of the token cannot show or demonstrate the benefits or effectiveness of their offset investment and hence climate impact.

The quality of the pool is only as good as the quality of the worst credit in the pool. Purchasing and mixing credits from many sources into the pool risks devaluing the token through adverse publicity related to expired credits and fraudulent, under-performing or zombie projects included in the pool.

The high transaction costs of minting tokens on Etherium is an obstacle to deploying more the sophisticated solutions required to ensure transparency and quality.

The net result of these limitations is an inevitable market devaluation of single pool wrapped carbon credit tokens. Such tokens may hold speculation value but do not present a credible carbon offset investment for discerning buyers whose main requirement is a clear and public demonstration of their positive climate impact.